The industrial property market includes warehouses, garages and distribution centers.

Key customers of industrial spaces are retailers, distributors, manufacturers, and logistics operators. As with other markets, recent economic conditions and trade sanctions have affected the industrial market. Low export volumes especially contributed to many key industrial investment factors weakening.

Russian industry: hoping for a better 2020

Even though overall industrial production growth softened in 2019, some investment-driven sectors outperformed, including those focused on agriculture, oil downstream, chemicals, construction and transportation. For 2020 we continue to expect acceleration given the budget stimulus that had already been planned and potential extra injections.

Industrial production in 2019: pressured by OPEC+, weather, and pessimism over local consumer demand

Russian industrial production accelerated from 0.3% year on year in November to 2.1% YoY in December, somewhat below our 2.7% YoY expectations. We note, however, that both November and December data have been distorted by calendar effects: November 2019 had 1 workday less than November 2018, while December 2019 had 1 workday more than December 2018. Moreover, December data benefited from the splurge in year-end budget spending, which further complicates forecasting and lowers the indicative power of year-end statistics.

In full-year terms, industrial production (around 23% of the Russian GDP) decelerated from 2.9% YoY in 2018 to 2.4% YoY in 2019, which came in slightly below our 2.5% expectations. We don't take it as a sign of material deterioration of the industrial output trends for the following reasons:

- The two key sectors that assured up to 80% of the slowdown were commodity extraction (37% of industrial output, growth decelerated from 4.1% in 2018 to 3.1% in 2019) and electricity&heat distribution (11% of industrial output, growth decelerated from 1.6% to 0.4%). This was a result of Russia's OPEC+ commitments to limit oil production and warm weather conditions that lowered local demand for electricity&heat (and therefore for gas production as well).

- Manufacturing (50% of industrial output), the key portion of Russian industry, posted only a modest slowdown from 2.6% in 2018 to 2.3% in 2019, which is still an impressive figure given that for most of the year budget policy was not supportive, with the VAT hike pressuring consumer demand and budget spending dynamics improving only at the very end of the year.

- Looking at the composition of the manufacturing output, the slowdown was driven by consumer-focused sectors (light vehicles, household appliances, office supplies, clothes), while others stand out as showing improved dynamics in 2019 vs. 2018, including oil downstream (7% of total industrial output), chemicals (4% of total), construction materials and metals (8% of total), and machinery and equipment focused on the agricultural sector.

Overall, the 2019 industrial output data points at a very limited negative reaction to adverse external and internal factors.

Budget policy will matter more in 2020

Looking into 2020, we see scope for acceleration in the industrial output growth, mainly thanks to the expected increase in the budget support.

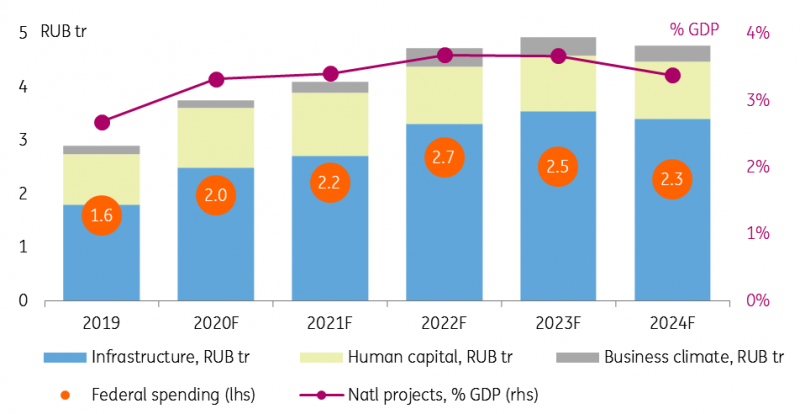

- Even before the recent government reshuffle, the overall size of National Projects (state spending on hard infrastructure and human capital) was supposed to increase from 2.7% GDP in 2019 to 3.3% GDP in 2020.

- The composition of the new government suggests that the issue of spending backlog will be addressed. For example, the federal budget underspent around RUB150 bn on National Projects in 2019 (RUB1.60 tr was spent vs. a planned RUB1.75 tr), and this sum may be carried over to 2020, adding to the existing plan of RUB2.0 tr. Higher confidence in the government's ability to fulfil spending plans will be key in supporting optimism in the investment-driven industries.

- The presidential address from last week suggests that social policy will be an important priority as well, which means that the overall spending backlog accumulated over the previous years and totaling RUB1.1 tr (or 1.0% of GDP) might be repositioned in favour of additional support to household income, which may boost confidence among consumer-focused industries.

For now, we keep our previous expectations of industrial output accelerating to 2.7% in 2020 and see some upside risks to this forecast if the government confirms plans to accelerate spending. Amendments to the budget plan (which even before the reshuffle, assumed 7% nominal growth in federal budget expenditure in 2020) are expected to follow by 11 February.

Meanwhile, if higher budget spending will not be accompanied by systemic measures aimed at promoting broad-based business climate, its effect on economic growth might be limited, and the higher dependence of growth on state-driven sectors will remain a longer-term concern.

Timeline of national Projects