The COVID-19 pandemic has plunged the global economy into its deepest recession since World War II. Despite substantial policy support, global GDP in 2020 is projected to contract by 5.2 percent, followed by a recovery of 4.2 percent in 2021.

A Decade of Growth

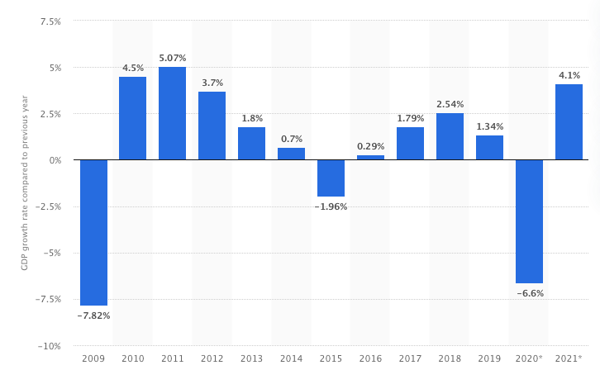

After the financial crisis of 1998, Russia quickly began seeing impressive economic prosperity, which lasted for a decade. The speed of this recovery can be seen through the GDP growth, which accelerated from -5.3 % in 1998, to 6.4% in 1999. The upward trend continued, for between 1999 and 2008 real GDP increased an average of 6.9% per year. In 2007 Russia’s GDP had grown beyond that of 1990, which held an important meaning in the country having moved past the hardships that followed the fall of the Soviet Union. This prosperity wasn’t visible in every sphere however, for inequality had grown, inflation rates remained high, and life expectancy relatively low. Still, between 1999-2008 average real wages increased 10.5% per year and real disposable income grew 7.9%. In addition, unemployment declined from 12.6% to 6.3%. These portray not only a growing economy, but also Russia’s increasing reach in global markets. Foreign investment had also become increasingly compelling with cheap foreign credit and rising commodity prices.

In 2005 the energy sector underwent significant changes. Russia signed a deal with Germany to connect the two countries with a gas pipeline. Later in the year the state became the majority shareholder of gas giant Gazprom, who soon gained control over Sibneft, an oil company. In 2006 Putin entered into economic agreements with China, which also involved a deal on transferring gas to China. These portray not only a growing economy, but also Russia’s increasing reach in global markets. Foreign investment had also become increasingly compelling with cheap foreign credit and rising commodity prices.

Russian economic growth is projected at -4 percent in 2020, a less severe contraction than the forecast of September. The revision reflects the better-than-anticipated economic performance in quarter 3. Consumer and business confidence are expected to improve assuming a vaccine deemed safe and effective is rolled out; this would pave the way for a gradual rebound at 2.6 and 3.0 percent in 2021 and 2022, respectively.

However, a more adverse scenario suggesting a sharp growth in new COVID-19 cases continuing in the second half of 2021 could further weigh on economic activity. In such a case, GDP in 2021 is projected to grow by 0.6 percent, with consumers and investment demand affected more deeply, and to increase by 2.8 percent in 2022.