Kazakhstan continues to develop, the value of property continues to increase in key areas.

RESIDENTIAL

As a result of the economic downturn, and significant weakening of the national currency, market sentiment in Kazakhstan’s residential sector is becoming increasingly negative, with buyers and sellers taking a hold position. Domestic buyers have in particular been adversely affected by the increase in interest rates that has accompanied the economic turmoil. The crash in currency has also depressed the price of residential real estate in dollar terms. There has been an increasing desire from the government to try and stimulate the residential construction sector via the increasing supply of mortgage products by specialisaed institutions such as the Kazakhstan Mortgage Company (KMC) and Zhilstroyserbank. KMC changed its credit conditions for the purchase of housing and the developers of multi-family residential houses by decreasing interest rate offered to such lenders. The system of evaluation of borrower’s solvency remains strict however, with paying capacity of customers checked very thoroughly. In a similar vain. Zhilstroyserbank will grant loans to some ‘special-priority’ groups of the population at an interest rate as low as 4% per annum. The supply of residential real estate doesnot appear to have been affected by the crash however. As Kazakhstan continues to develop, the value of property continues to increase in key areas. Over the past year and a half, the property price index increased by 12 units, which is of statistical significance. As a result of the weakening of the KZT, the prices of residential property quoted in US dollar terms have declined. Businesses have generally tried to adjust for that loss by increasing the prices of their properties, in tenge,is illustrated by the increase of pricing in the property index.

INTRODUCTION TO ASTANA

Astana, formerly known as Aqmola, was chosen as the new capital of Kazakhstan in 1998. Located among the vast steppes in the central-northeastern part of Kazakhstan, Astana consists of the Almaty, Saryarqa, and Esil districts, covering over 722 sq kilometers and hosting a population of 870,000. An interesting choice of word, ‘astana’ in the Kazakh language literally means “capital city.”

Occupying a strategic location, Astana serves as a regional hub of business and political relations connecting Asia and Europe. Despite being a relatively young city, Astana’s economy has developed rapidly over the past two decades. Some of the city’s best performing sectors are car manufacturing, construction and infrastructure development, and food processing industries.

The economy of Astana has been rapidly expanding. Over the last 10 years, Astana’s GDP grew annually by 17%. The city, as a result, is on track to become one of the most developed economic centers in all of Central Asia. The development of the new AIFC will further enhance such status.

Currently, Astana’s total supply of housing stock stands at 123.4 million sq meters. Since 2001, the total supply of housing stock has been consistently increasing at around 10% per annum. A combination of public and private (domestic and international) investors continue to finance the increase in Astana’s housing stock. Two state run programs are likely to further stimulate growth in the residential sector over the coming years; the “Affordable Housing 2020,” and the “Astana Expo – 2017”.

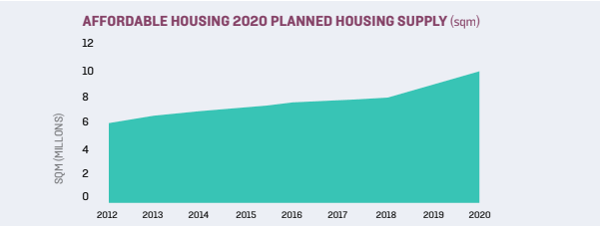

Started in 2012, the “Affordable Housing 2020” is a long term housing construction program that intends to increase the availability of housing for the residents of Kazakhstan. As a whole, the program plans to add a total of 59 million sq metres of residential space across the nation by 2020, by which time construction will have reached 10 million sq meters per year. This will include the construction of over 50,000 apartments by 2020.

INTRODUCTION TO ALMATY

Located at the foothills of the famous Alatau mountain ranges, Almaty is the largest city in Kazakhstan, and served as the capital of the country between 1929 and 1997. Throughout the history of the Kazakh people, Almaty has played a significant role. Dating as far back as the 8th century, Almaty served as both the political, and economic center, of every regime to occupy the Kazakh territory. Most famously, during the Middle Ages, between the 12th and 15th centuries, Almaty served as the key center of the historical Silk Road, which extended as a trade route between Europe and Asia. Almaty is 500 to 600 meters above sea level and the fauna of the land is rich and diverse. Due to its location in the southern part of Kazakhstan, the region’s winters are not as harsh as the northern parts of the country.

Although the majority of residents are ethnic Kazakhs, the city has a diverse population, with a notable expatriate community living and working in the city. Given that Almaty is both financially vibrant and economically prosperous, whilst also being home to well-developed industries and hospitable climate conditions, it is reasonable to expect the population of the city to continue to grow at a healthy rate.

The ‘cool down’ of the residential market segment, has resulted in many developers leaving the market all together. Only the most financially robust developers have continued with construction activities, although at slower rates. Commissioned residential space in Q1 2016 for Almaty was 490,124 sq meters, representing a 2.3% increase compared to Q1 of 2015. New residential space has increasingly been commissioned by the state under the ‘Affordable Housing- 2020’ program implemented in Q2 2012. The Asyl Arman Residential Cluster, nine 72 storey properties were built under the scheme. Such developments are part of the government's aim to construct 10 million m 2 of new real estate per year by 2020. The volumes of commissioned residential space in Kazakhstan showed a 23% increase in Q1 2016 relative of Q1 2015. The share of commissioned residential space found in Almaty (19.8% of total) was second only the city of Astana (22.2% of total). Housing stock in 2015 also increased to just under 2,900 ‘000s/square meters, continuing the steadily increasing trend seen over the past 5 years.