It is well-known that real estate has been slow to catch up with the burgeoning use of data science in financial analysis. However, things are starting to change:

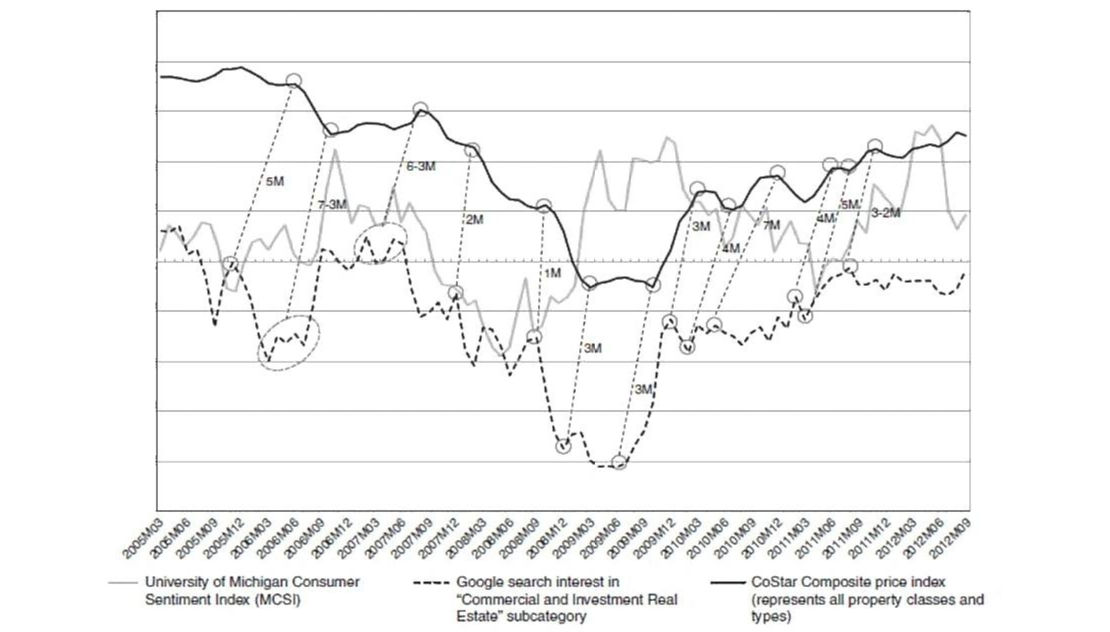

Some recent research has used Google search trends as a tool to predict real estate prices with great success. Essentially, the research involves getting region-by-region search volume data for terms such as “commercial property”, “commercial real estate”, and “jones lang lasalle.” This has shown to be highly predictive of medium-term real estate price movements. In fact, Google search volume was seen to be more predictive than models using macroeconomic and transaction-level data. See the below image for U.S. market results (Dietzel et al. 2014).

How can this apply to emerging markets?

When this research is applied to emerging markets things get even more interesting. Emerging markets notoriously have a data availability problem, which makes Google search volume all the more useful since it is one of the few accessible data feeds that is both highly precise and available virtually in real time. So what are the results?

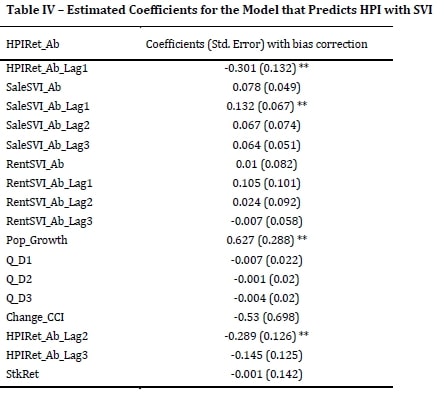

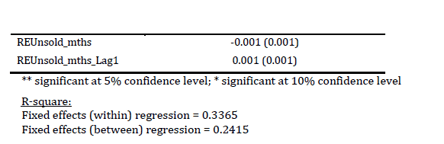

Venkataraman et al. (2017) conducted an analysis for four large cities in India and found that Google search volume data was eight times as predictive as it was in the U.S.[1]. For example, a 1% increase in the search intensity for the word “sale” within Google’s real estate category lead to a 0.132% abnormal quarterly increase in housing prices. This is while controlling for factors such as population and construction costs[2]. Because of the delays associated with getting Indian real estate data, this means that Google trends data could be particularly relevant in evaluating Indian real estate markets.

Still Reasons to Be Cautious

The success of Google trends data is a promising development that is broadly indicative of the power of alternative data in a world in which traditional data sources aren’t always reliable. It gives a base case for how technology can provide elements of transparency that will facilitate investment into underdeveloped and emerging markets.

While the results of these studies are encouraging, there is still reason to be cautious about using Google search volume data to predict real estate movements. Here at Propeterra we conducted an internal econometric analysis on the predictive power of Google trends data on Singaporean real estate markets with disappointing results. Additionally, one should be cautious of using Google trends data where Google is not the primary search engine, such as in China or South Korea, or where levels of internet usage are weak, such as in Pakistan.

The Wrap

At Propeterra we enjoy staying on top of technology trends that will lead to new insights into the analysis of real estate markets. Sometimes, however, it is important to remain skeptical of which technologies and data sources will have a real impact on improving analytical insights.

Google trends is a promising source of data, especially in geographies where little reliable data is available. Nonetheless, for predicting real estate markets it offers mixed results.

[1] Mumbai, Delhi, Bangalore, Chennai

[2] For those who want to do a deeper dive see the notes (below) for the full econometric output (Venkataraman 2017)

Notes:

1) Venkataraman's Econometric output for Indian real estate (Source: Venkataraman 2017)

Lag is indicative of how many quarters prior the data is from. For example, SalesSVI_Lag1 is the predictive power of search volume for sales (Sales Search Volume Index) from one quarter prior on current real estate prices.

HPIRet_Ab = Abnormal return on the city (lag 1 for one quarter prior)

SalesSVI_Ab = Abnormal uptick in searches for the keyword “Sales”

RentSVI_Ab = Abnormal searches for the keyword “Rent”

Pop_Growth = Annual population growth

Q = Quarterly dummy variable to remove seasonal effects

Change_CCI = Prior period increase in construction cost index

StkRet = Stock market return of the previous period

REUnsold_mths = Number of vacancy months in the past two quarters for the given city

Sources:

a) "Does Internet Search Intensity Predict House Prices in Emerging Markets? A Case of India" (2017). Authors: Ekta Jalan, Venkatesh Panchapagesan, Madalasa Venkataraman

b) "Sentiment-based commercial real estate forecasting with Google search volume data" (2014). Authors: Marian Dietzel, Nicole Braum, Wolfgang Schafers