When Russia began its transition from a socialist state to a market-controlled one, the political and economic instability initially induced little international interest in the real estate market.

Russian real estate is attractive for investment as legislation is often thought of as simpler than that of England or Germany, for example.

The COVID-19 pandemic has plunged the global economy into its deepest recession since World War II. Despite substantial policy support, global GDP in 2020 is projected to contract by 5.2 percent, followed by a recovery of 4.2 percent in 2021.

It is well-known that real estate has been slow to catch up with the burgeoning use of data science in financial analysis. However, things are starting to change:

A critical aspect of investing in emerging markets is the need to discriminate between short-term growth fads and sustainable development. As Paul Krugman famously discusses in his article, “The Myth of Asia’s Miracle,” it is often very easy to get caught up in aggregate GDP growth statistics without looking deeper into what is driving those statistics. This can lead to an investing-with-the-herd mentality and the systematic under-appreciation of some of the most interesting and lucrative opportunities across emerging markets.

Asia pacific investment partners

Mongolian Properties

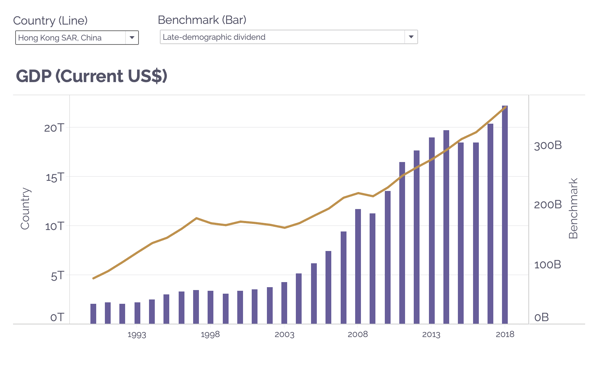

GDP per capita - Hong Kong

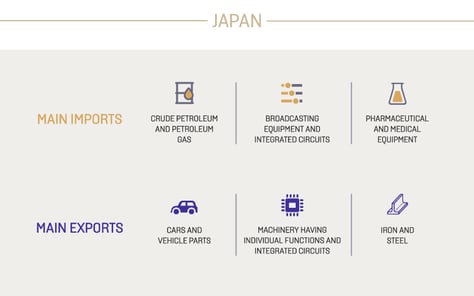

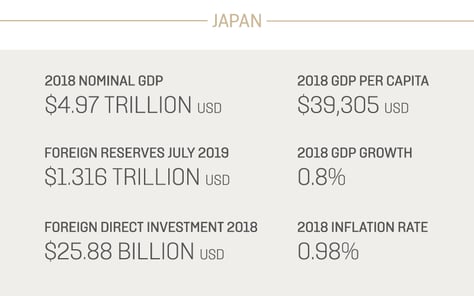

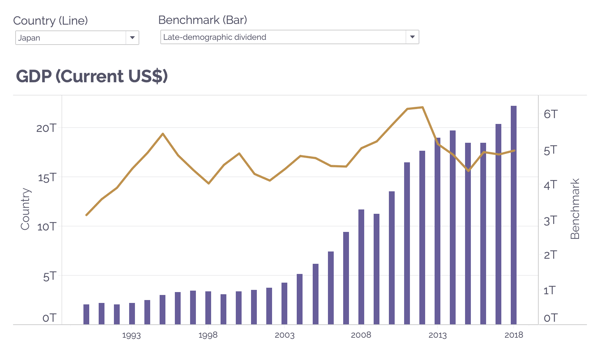

GDP - Japan

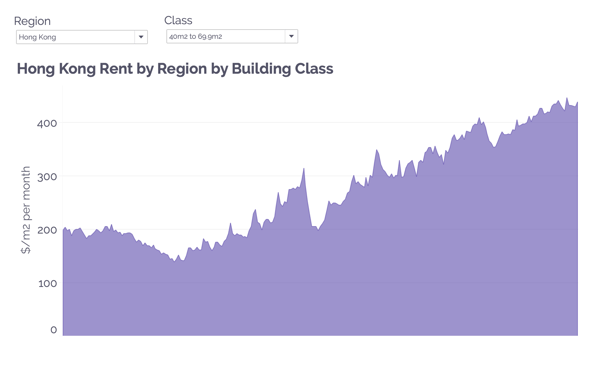

Rent - Hong Kong

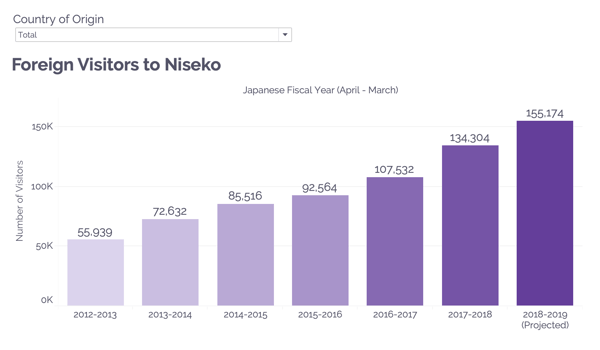

Foreign Visitors to Niseko

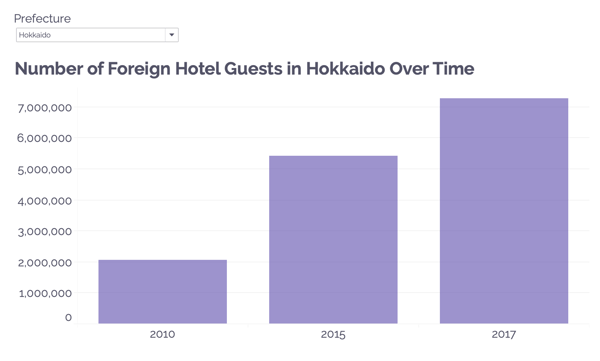

Foreign Hotel Guest in Hokkaido

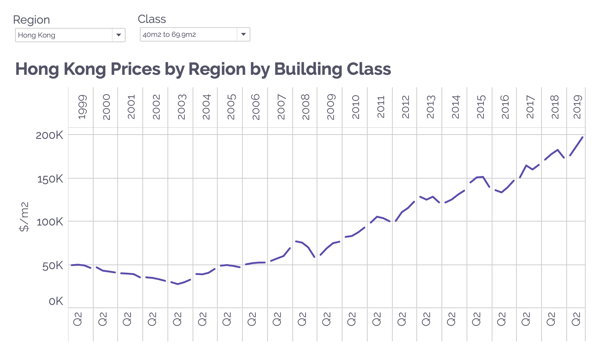

Residential Prices - Hong Kong